-

by

Step 1: Create Expense Ledgers

Go to:

Gateway of Tally > Accounts Info > Ledgers > Create

Create these 3 ledgers one by one:

| Name | Under Group |

|---|

| Toll Charges | Indirect Expenses |

| Insurance Charges | Indirect Expenses |

| FC Charges | Indirect Expenses |

Step 2: Enable Vehicle Tracking (Cost Centre)

Press F11 (Features) > Accounting Features

Maintain cost centres: Yes

Step 3: Create Vehicle Names as Cost Centres

Go to:

Gateway of Tally > Accounts Info > Cost Centres > Create

👉 Create all your 20 vehicles like this:

- TN01AB1234

- TN01AB5678

- TN01XY7890

(…up to 20)

Step 4: Record Toll, Insurance, FC (Monthly)

Use Payment Voucher (F5)

👉 Example:

For Toll:

| Particulars | Amount | Cost Centre (Vehicle) |

|---|---|---|

| Toll Charges | ₹3000 | TN01AB1234 |

| Cash / Bank | ₹3000 |

Step 5: To See Report Vehicle-wise

Go to:

Gateway of Tally > Display > Cost Centre Reports > Cost Centre Breakup

👉 Select any vehicle number.

You will see Toll, Insurance, FC expenses month-wise.

✅ Summary

| Task | In Tally |

|---|---|

| Create Ledgers | Indirect Expenses group |

| Enable Vehicle Tracking | F11 > Accounting Features |

| Create Vehicle List | As Cost Centres |

| Record Payments | Use F5 Voucher & Select Vehicle |

| View Report | Display > Cost Centre Reports |

-

byBIT

-

August 7, 2025

You May Also Like

-

Sep 25, 2025

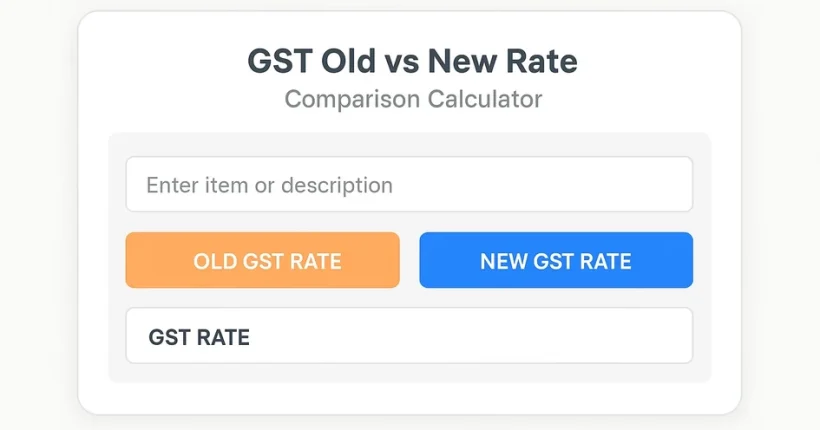

GST Old vs New Rate Finder Merged Dataset Search products, enter taxable value and compare old vs new GST amounts....

-

Sep 25, 2025

GST Rate Comparison Calculator Enter Taxable Value (₹): Old GST Rate (%): 5%12%18%28% New GST Rate (%): 5%12%18%28% Compare Rates

-

Sep 25, 2025

The Goods and Services Tax (GST) Council has announced several important updates. These changes affect daily-use products, apparel, footwear, food...

-

Aug 26, 2025

Introduction 🧾 What Is the QRMP Scheme?The QRMP Scheme allows eligible taxpayers to file GST returns quarterly while making...

Sign up to receive our latest updates

Get in touch

Address

152A, Annavalaivu, Thuvakudimalai, Tiruchirappalli, Tamil Nadu – 620 022

Landmark : Near Post Office

Landmark : Near Post Office

bloomingtutorial@gmail.com