-

by

Not all businesses in India are required to register for GST.

But many small sellers and service providers get confused when someone asks for an Enrolment ID or UIN, even if they aren’t registered under GST.

If you’re wondering:

- Can I sell without GST and still do it legally?

- What is an Enrolment ID or UIN?

- How can a seller who isn’t registered for GST get one?

This guide explains everything in a clear and simple way, step by step.

Who Can Sell Without GST Registration?

Not all businesses need to register for GST.

The GST rules allow some sellers and service providers to run their businesses legally without GST registration, as long as they meet certain conditions.

You can sell without GST registration if any of the following apply to you:

1.Your Annual Turnover Is Below the GST Threshold Limit

If your total yearly income is below the limit set by the government, you are not required to register for GST.

- For service providers: Up to ₹20 lakh per year

- For goods sellers: Up to ₹40 lakh per year (in most states)

If your income stays below this limit, you can keep running your business without GST registration.

2. You Provide Goods or Services That Are Not Subject to GST

Some products and services are completely free from GST.

Examples are:

- Particular education or training services

- Certain medical services

- Some basic or hand-crafted items

If your business only offers these exempt goods or services, you don’t need to register for GST, even if you make money from them.

3. You Are an Individual, Freelancer, or Home-Based Business Owner

GST rules are made to help small and self-employed people.

You don’t have to charge GST if you are:

– An individual who provides services

– A freelancer or consultant

– Running a small business from home

These types of businesses usually:

– Work with local customers

– Have low expenses

– Make less than the GST limit

For these kinds of sellers, registering for GST is not required.

It’s optional.

4. You Do Not Fall Under Mandatory GST Registration Categories

Some businesses have to register for GST even if their income is low.

If you don’t fit into those groups, you don’t need to register.

Mandatory GST registration is needed for:

– Some sellers who operate across states

– Certain online businesses

– Companies that must take or pay taxes

If none of these apply to your business, you can still sell products or services without GST and it’s still legal.

Common Examples of Non-GST Sellers

Here are some actual examples of people who usually don’t register for GST:

- Those who give beauty services or treatments from their home

- People who work as freelancers, like writers, designers, editors, and consultants

- Tutors, trainers, and coaches

- Local service providers who run small businesses

These people often work on their own and make money within the set limits.

What is an Enrolment ID or UIN?

An Enrolment ID or UIN is a special number used to identify non-GST sellers.

Important things to know:

- It is not the same as a GSTIN

- It doesn’t mean that GST is applicable to you

- It is only used for identifying or following rules

Many websites or government offices ask for this number to check if a seller is running their business legally without having to pay GST.

Enrolment ID / UIN vs GSTIN

| Feature | Enrolment ID / UIN | GSTIN |

| Who gets it | Non-GST sellers | GST-registered sellers |

| Tax liability | No GST | GST applicable |

| Return filing | Not required | Mandatory |

| Purpose | Identification | Tax compliance |

When do non-GST sellers need an Enrolment ID or UIN?

You might be asked for an Enrolment ID or UIN in these situations:

– When you sign up on online platforms or marketplaces

– When you go through the process of becoming a vendor

– When you need to file clarifications or declarations

– When you work with clients who are registered under GST

– When you submit documents for verification

If no official body or platform asks for it, you don’t need to apply for one.

How to Get GST Enrollment Number from GST Portal (Online)

Follow these steps carefully

Step 1: Visit the Official GST Portal

Go to the GST official website

(Use Google search: GST portal India)

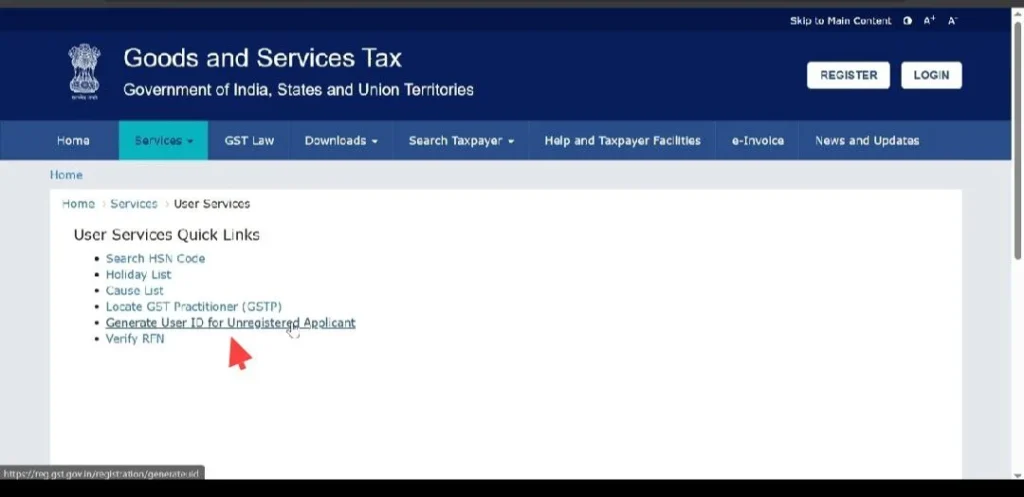

Step 2: Click on “Services”

From the top menu:

Services → User Services → Generate User ID for Unregistered Applicant

Step 3: Click on “Generate User ID for Unregistered Applicant.

- Click “Generate User ID for Unregistered Applicant.”

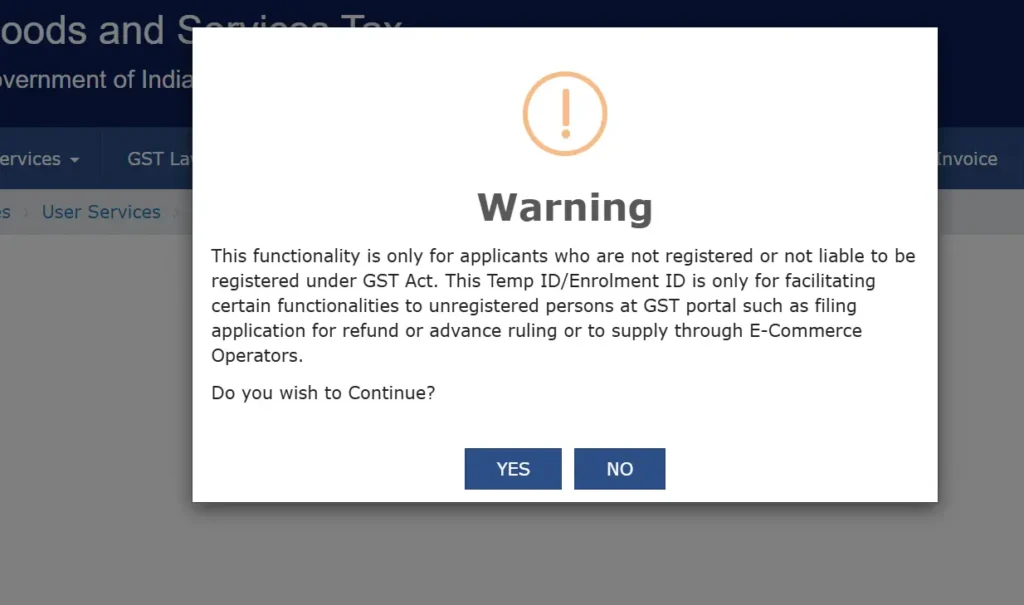

- When the pop-up appears, click “Yes.”

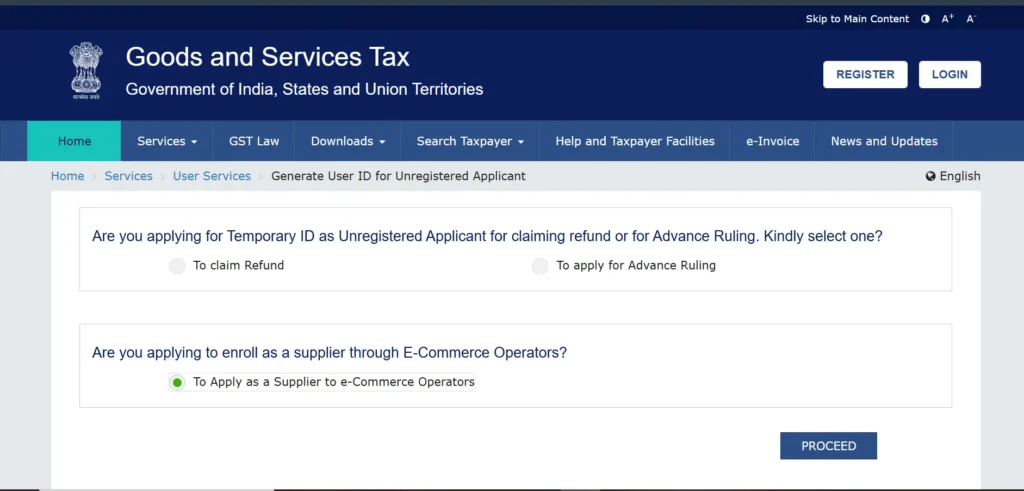

- Select “Are you applying to enroll as a supplier through E-Commerce Operators / To Apply as a Supplier to E-Commerce Operators.”

- Click “Proceed.”

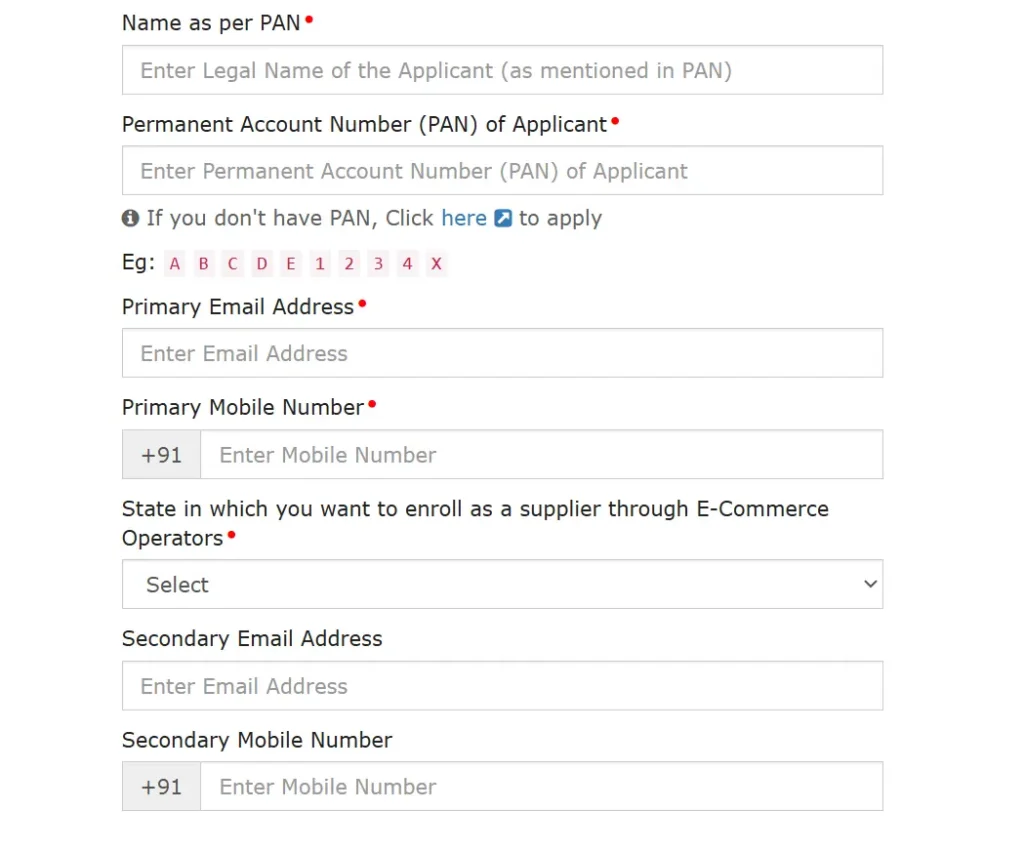

Step 4: Fill Basic Details

Enter:

- PAN number

- Email ID

- Mobile number

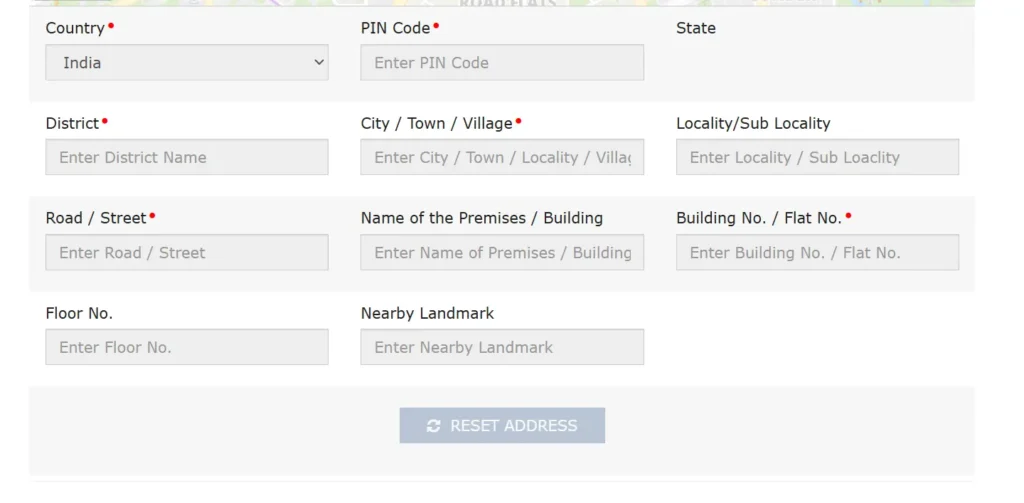

- Address details

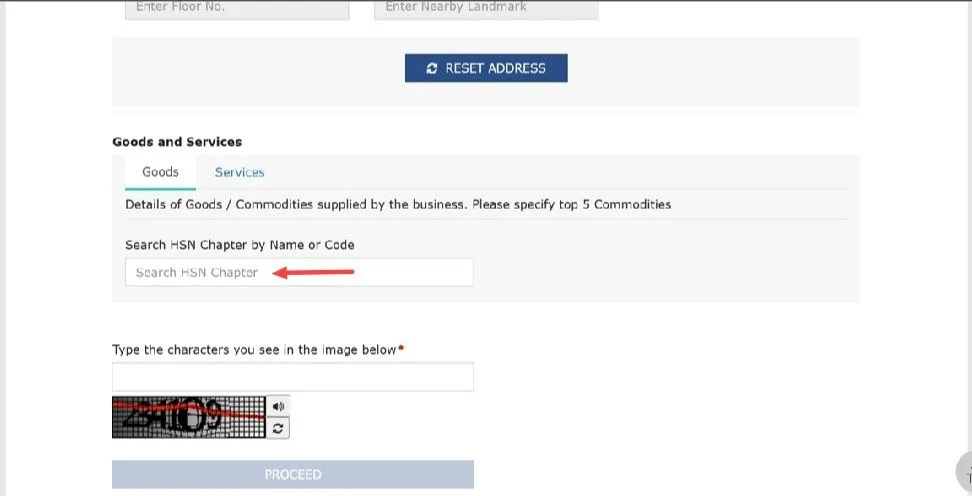

HSN Code Requirement:

Food-related and skincare products require GST registration and must be sold by filling the appropriate HSN code. Products such as gifts, dresses, decorations, and other similar items can be sold without GST, after checking that they are GST-exempt.

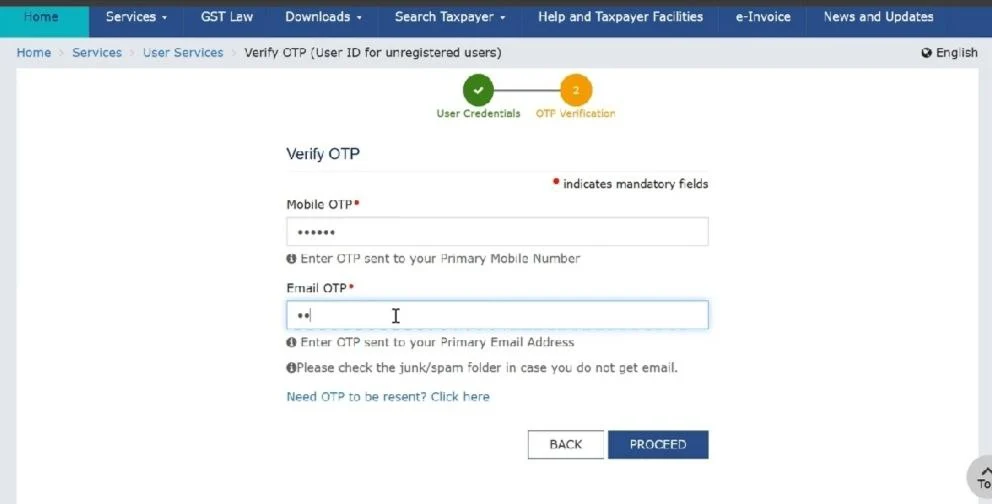

Step 5: Receive Temporary Reference Number (TRN)

After OTP verification:

- You will receive a TRN (Temporary Reference Number)

- This TRN works as your GST Enrollment Number

It is sent to:

- Registered email

- Registered mobile number

Do not delete this message

Is an Enrolment ID required for all non-GST sellers?

❌ No.

You need an Enrolment ID or UIN only in the following situations:

- If a portal or authority asks for it

- If you are filing clarifications

- If vendor verification requires it

Otherwise, you can run your business without GST and without an enrolment ID.

Common mistakes non-GST sellers should avoid:

- ❌ Applying for GST when it’s not needed

- ❌ Confusing Enrolment ID with GSTIN

- ❌ Thinking enrolment means you have to pay taxes

- ❌ Sharing wrong business details

Remember: Having an Enrolment ID does not mean you are registered for GST.

Final Thoughts: Selling Legally Without GST

It’s completely legal to sell without GST if your business meets the eligibility criteria.

An Enrolment ID or UIN is just a tool that helps:

- Identify non-GST sellers

- Keep records

- Ensure everything is done properly

As long as your business type and turnover qualify, you can operate legally without GST registration and without extra hassle.

Frequently Asked Questions

What is an Enrolment ID or UIN for non-GST sellers?

An Enrolment ID or UIN is a special number given to people who sell goods or services but are not registered for GST.

It helps them be recognized when they need to use certain online platforms or meet some legal requirements.

Is Enrolment ID the same as GSTIN?

No.

GSTIN is a number given only to businesses that are registered under GST. Enrolment ID or UIN is for businesses that are not registered under GST.

Do non-GST sellers have to pay GST if they get an Enrolment ID?

No.

Getting an Enrolment ID or UIN does not mean they have to pay GST. They only need to pay GST once they are officially registered.

Is Enrolment ID required for all non-GST sellers?

No.

It’s only needed if a website, platform, or authority asks for it.

Can a non-GST seller apply for GST later?

Yes.

If their sales reach a certain amount, they can choose to register for GST at any time.

Do non-GST sellers need to file GST returns?

No.

They only need to file GST returns after they are officially registered for GST.

This FAQ format helps your article appear in Google’s “People Also Ask” section.

-

byNila7

-

January 27, 2026

Tags:

You May Also Like

-

Jan 31, 2026

-

Sep 25, 2025

-

Sep 25, 2025

-

Sep 25, 2025

Sign up to receive our latest updates

Get in touch

Address

Landmark : Near Post Office