-

by

Student Asks Question:

Ma’am, salary is paid on 5th of next month, but our office enters it as if it was paid on 31st. What’s the correct way to do it in Tally?

Answer

They don’t pay salary exactly on the last date of the month (like 31st August), but they still want the salary to show under August expenses. Why? So that the accounts for that month are accurate.

Do this in Tally in two simple steps:

Step 1: On 31st August – Just Say Salary Is Due

You’re not paying it, you’re just saying:

“Salary for August is pending. I will pay next month.”

This is called a Journal Entry.

In Tally, press F7 – Journal

Date = 31st August

Entry:

Salaries A/c Dr ₹50,000

To Outstanding Salaries A/c ₹50,000

To Outstanding Salaries A/c ₹50,000

This means:

“Salaries are recorded as expense, but not paid yet.”

Step 2: On 5th September – Actually Pay the Salary

Now the real cash or bank payment happens.

Use F5 – Payment in Tally

Date = 5th September

Entry:

Outstanding Salaries A/c Dr ₹50,000

To Bank A/c ₹50,000

To Bank A/c ₹50,000

That’s it. Salary is cleared.

Why this is the correct way?

Because:

- You didn’t pay on 31st, so don’t show payment on 31st.

- But you want salary to show in August’s accounts, so you make it outstanding on 31st.

- Then when you actually pay, it clears from outstanding.

Groups in Tally:

| Ledger | Group |

|---|---|

| Salaries A/c | Indirect Expenses |

| Outstanding Salaries A/c | Current Liabilities |

| Bank A/c | Bank Accounts |

-

byBIT

-

August 7, 2025

Leave A Reply Cancel reply

You May Also Like

-

Sep 25, 2025

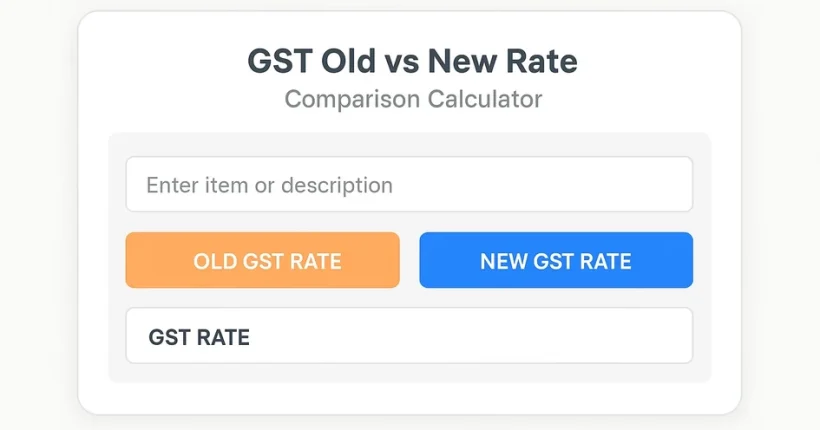

GST Old vs New Rate Finder Merged Dataset Search products, enter taxable value and compare old vs new GST amounts....

-

Sep 25, 2025

GST Rate Comparison Calculator Enter Taxable Value (₹): Old GST Rate (%): 5%12%18%28% New GST Rate (%): 5%12%18%28% Compare Rates

-

Sep 25, 2025

The Goods and Services Tax (GST) Council has announced several important updates. These changes affect daily-use products, apparel, footwear, food...

-

Aug 26, 2025

Introduction 🧾 What Is the QRMP Scheme?The QRMP Scheme allows eligible taxpayers to file GST returns quarterly while making...

Sign up to receive our latest updates

Get in touch

Address

152A, Annavalaivu, Thuvakudimalai, Tiruchirappalli, Tamil Nadu – 620 022

Landmark : Near Post Office

Landmark : Near Post Office

bloomingtutorial@gmail.com

1 Comment

Super