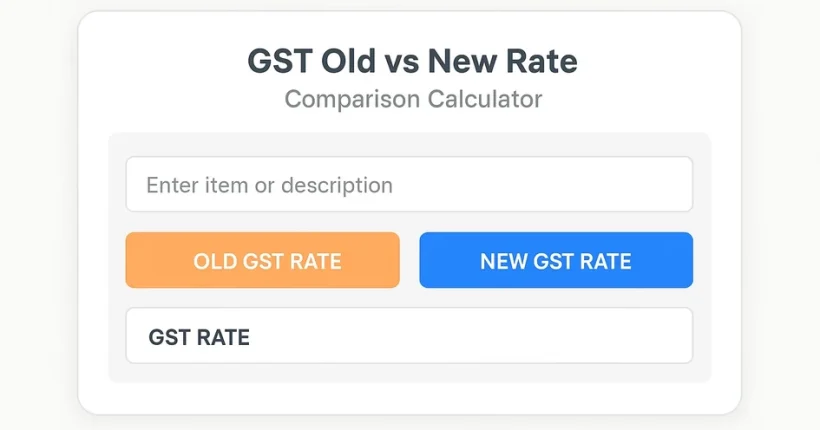

GST Old vs New Rate Comparision Calculator

September 25, 2025

Merged Dataset

Search products, enter taxable value and compare old vs new GST amounts. Color-coded change: red = increase, green = decrease, blue/grey = exempt/neutral.

GST Comparison

| Item | Old Rate | New Rate | Old GST (₹) | New GST (₹) | Difference (₹) |

|---|

Summary

Old GST Rate

—

New GST Rate

—

Old GST Amount

—

New GST Amount

—

Difference

—

You May Also Like

-

Jan 31, 2026

How to Open a Meesho Seller Account Using Enrolment ID (Without GST) Starting an online business can feel confusing, especially...

-

Jan 27, 2026

Not all businesses in India are required to register for GST.But many small sellers and service providers get confused when...

-

Sep 25, 2025

GST Rate Comparison Calculator Enter Taxable Value (₹): Old GST Rate (%): 5%12%18%28% New GST Rate (%): 5%12%18%28% Compare Rates

Sign up to receive our latest updates

Get in touch

Address

152A, Annavalaivu, Thuvakudimalai, Tiruchirappalli, Tamil Nadu – 620 022

Landmark : Near Post Office

Landmark : Near Post Office

bloomingtutorial@gmail.com