-

by

Introduction

🧾 What Is the QRMP Scheme?

The QRMP Scheme allows eligible taxpayers to file GST returns quarterly while making tax payments monthly. It aims to reduce the compliance burden for small businesses with a turnover of up to ₹5 crore.

Benefits of filing the Form to Change Profile for QRMP Scheme:

Quarterly GSTR-3B filing

Monthly tax payment via PMT-06

Reduced compliance cost

Easy ITC claim for buyers

🔄 Why Change Your QRMP Profile?

Taxpayers may want to update the Form to Change Profile for QRMP Scheme if:

Turnover exceeds the threshold

Preference for monthly filing

Not eligible for QRMP anymore

Opt-in again after opting out

📝 Step-by-Step Guide: How to File Form to Change Profile for QRMP Scheme on GST Portal

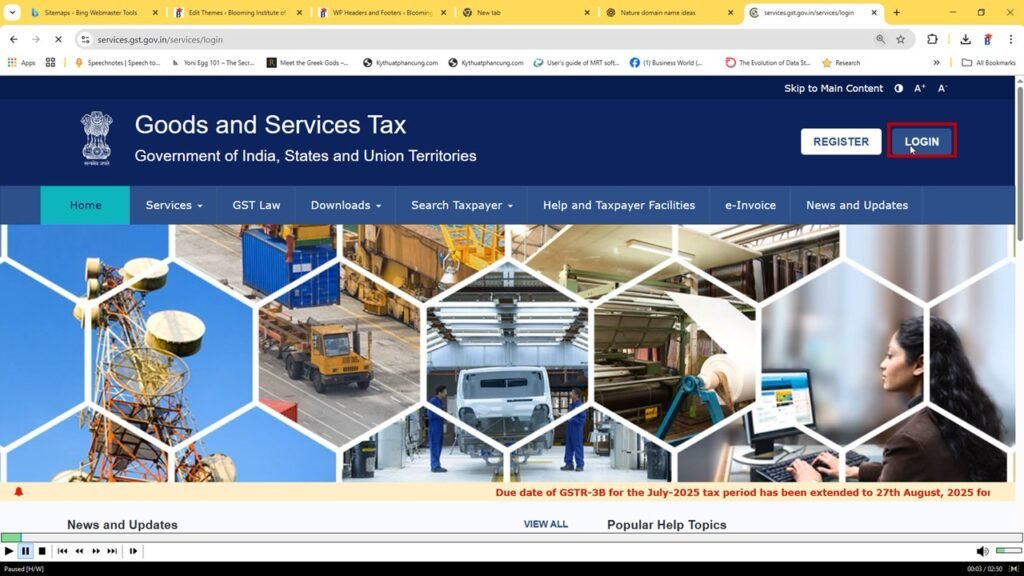

✅ Step 1: Login to GST Portal

Visit www.gst.gov.in and log in with your credentials to start filing the Form to Change Profile for QRMP Scheme.

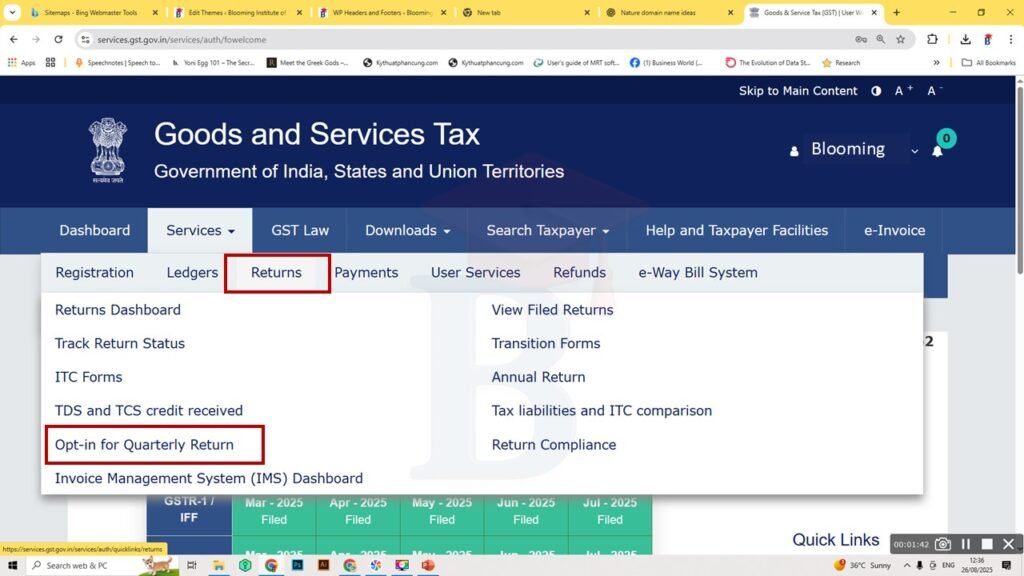

Step 2: Navigate to ‘Services’ > ‘Return’ > ‘Opt-in for QRMP Scheme’

Once logged in, go to the Services tab, click on Return, and then select Opt-in for QRMP Scheme.

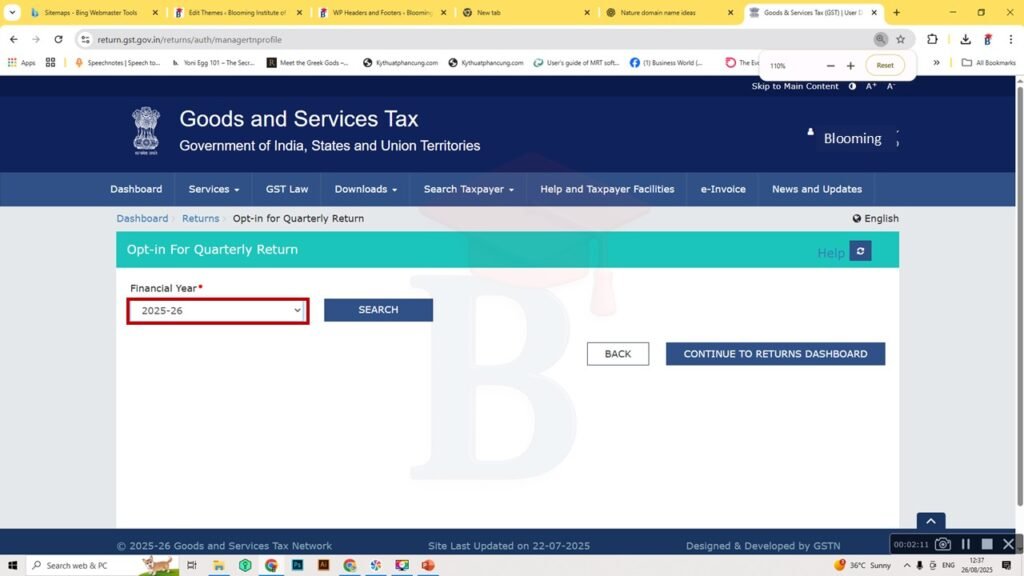

Step 3: Select the Financial Year

Choose the correct financial year for which you want to file the Form to Change Profile for QRMP Scheme.

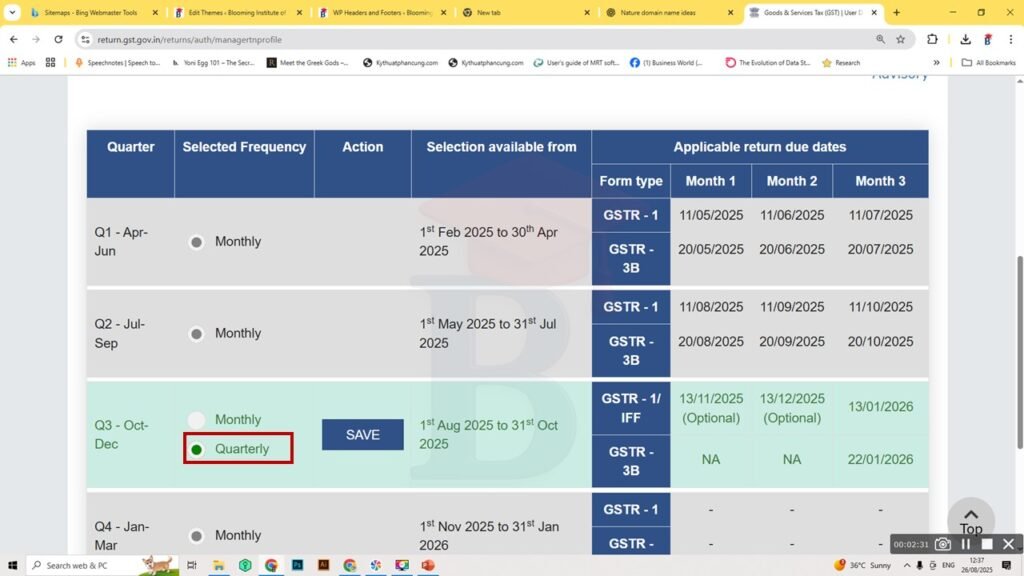

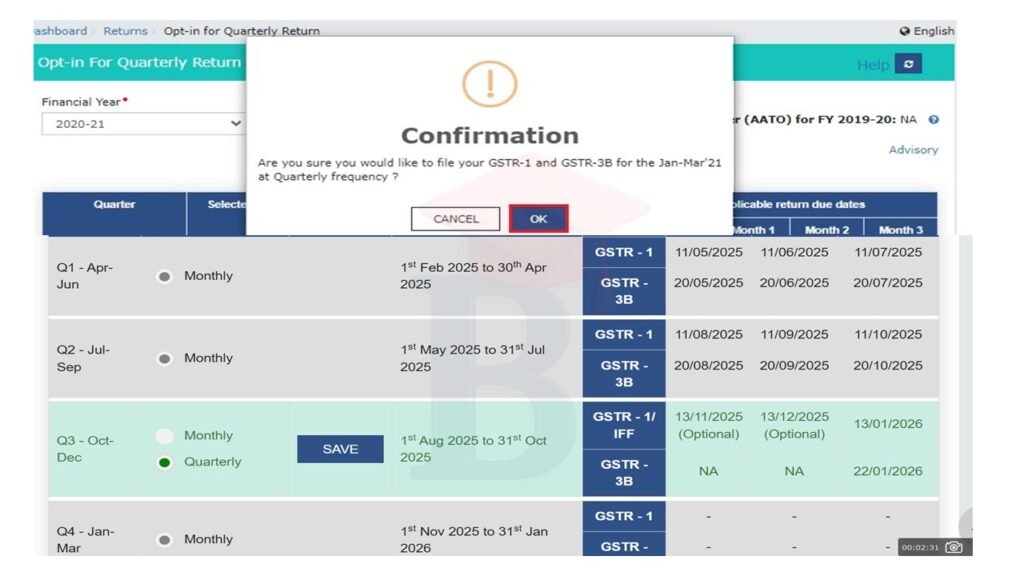

Step 4: Choose the Filing Frequency

Select Quarterly (opt-in) or Monthly (opt-out). This selection is finalized in the Form to Change Profile for QRMP Scheme.

Quarterly (if opting in)

Monthly (if opting out)

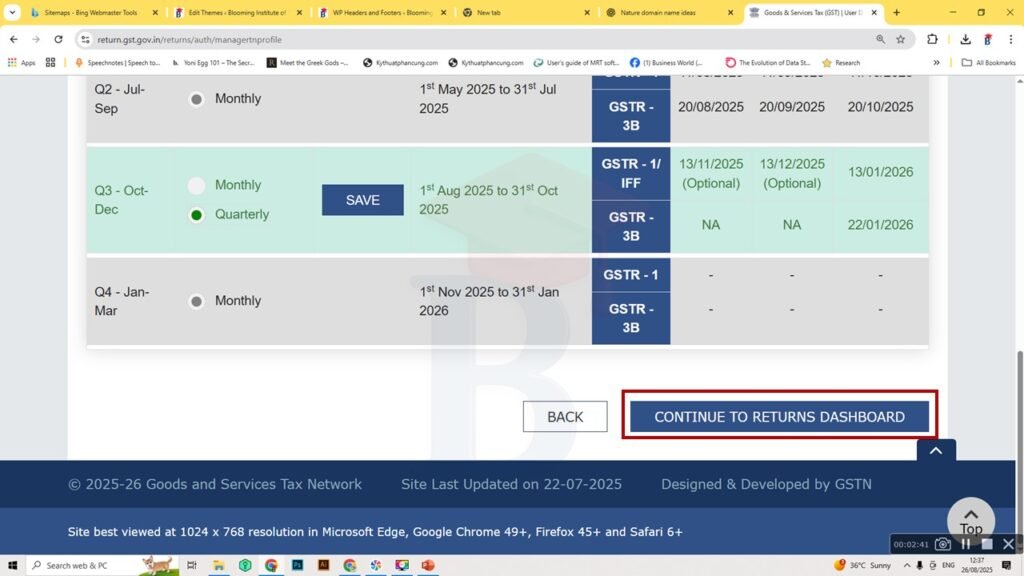

Step 5: Click Continue

Step 6: Confirm and Submit

Review your details and submit. The GST portal will show a confirmation that the Form to Change Profile for QRMP Scheme has been successfully filed.

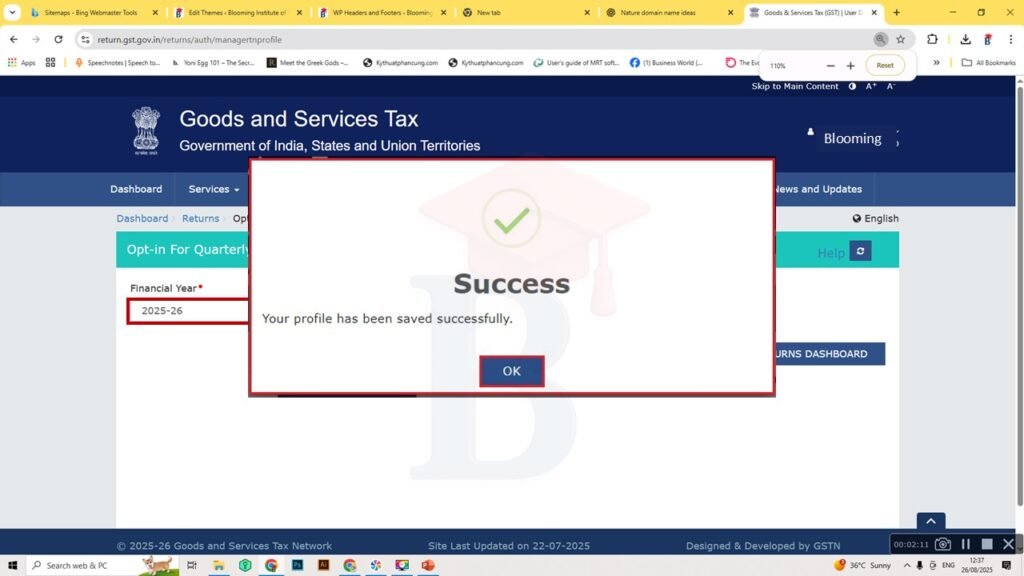

Step 7: Click OK

You’ll see message success

Important Dates to Change Profile

You can file the Form to Change Profile for QRMP Scheme during the window starting from the 1st day of the second month of the previous quarter to the last day of the first month of the current quarter.

For example, to change the filing frequency for the Oct–Dec quarter, you can make changes from 1 Aug to 31 Oct.

Eligibility for QRMP Scheme

To opt for the QRMP Scheme:

Aggregate turnover in the preceding financial year must be up to ₹5 crore

You must have filed your last return (GSTR-3B)

🔁 Opting In and Opting Out of QRMP Scheme

If you are under monthly filing and want to switch to QRMP, you can opt-in by updating your profile.

If you are under QRMP and want to switch back to monthly filing, you can opt-out by filing the same form.

🧮 Tax Payment in QRMP Scheme

Even though returns are filed quarterly, tax payments must be made monthly using Form PMT-06 by the 25th of the next month.

📌 Key Notes

The change will be applicable from the next quarter.

You cannot change the frequency mid-quarter.

Always check eligibility before making the switch.

QRMP vs Monthly Filing – Comparison Table

| Feature | QRMP Scheme | Monthly Filing |

|---|---|---|

| Return Frequency | Quarterly | Monthly |

| Payment Frequency | Monthly (PMT-06) | Monthly (GSTR-3B) |

| Compliance Burden | Low | Moderate |

| Suitable For | Small Taxpayers | Medium to Large |

🧠 Tips for Taxpayers

Review your annual turnover regularly

Make timely tax payments to avoid interest

Use GST portal notifications for deadline alerts

📌 Conclusion

The Form to Change Profile for QRMP Scheme in Trichy is a simple but important process for GST taxpayers. Whether you are a small shop owner, trader, or service provider in Trichy, updating your profile correctly ensures compliance and avoids penalties. Follow the steps carefully, keep track of eligibility, and file your returns on time.

-

byBIT

-

August 26, 2025

Tags:

You May Also Like

-

Jan 31, 2026

-

Jan 27, 2026

-

Sep 25, 2025

-

Sep 25, 2025

Sign up to receive our latest updates

Get in touch

Address

Landmark : Near Post Office