-

by

In a twist for a technology many of us assumed would only ever get cheaper, solid-state drives (SSDs) and other memory components like DRAM are becoming expensive and scarce — a development that’s already reshaping gadget pricing and could continue to do so into the near future. Here’s what’s behind the crunch — and what consumers should expect next.

🧠 The Heart of the Problem: Memory Demand Explodes

At the center of today’s price surge is exploding demand from artificial intelligence and cloud computing. Massive data-hungry AI systems don’t just need powerful CPUs and GPUs — they also require vast amounts of high-speed storage and memory. This has several knock-on effects:

- Data centers and AI infrastructure are snapping up SSDs and DRAM in huge quantities, leaving less available for everyday computers and devices.

- SSD manufacturers are prioritizing enterprise and AI-grade products — which are more profitable — over consumer-level drives.

- NAND flash (the memory inside SSDs) wafer supply has tightened sharply, pushing contract prices up between 20 % and over 60 % on some components.

This dynamic is so pronounced that some industry executives say entire annual production has already been sold out for 2026 and that the era of cheap 1 TB SSDs (which used to be affordable for many buyers) is likely behind us for now.

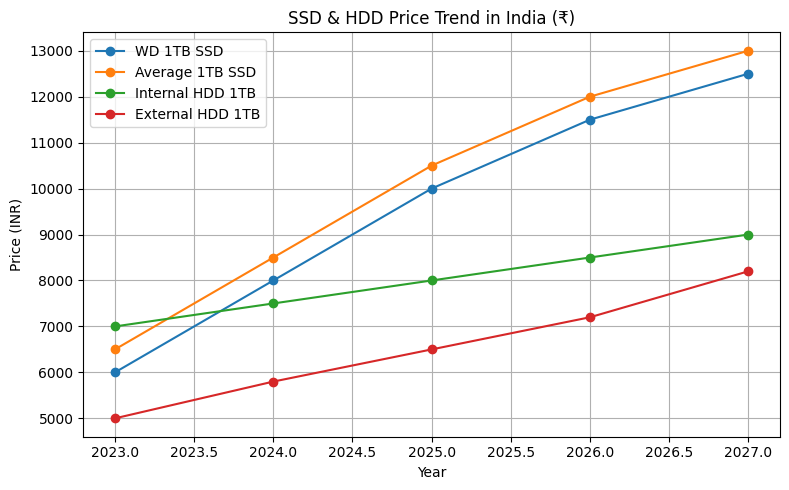

📈 SSD Prices Are Rising — Significantly

How this trend impacts the indian counsumer market

This isn’t just theory — prices are going up in practice:

- Recent reports show SSD prices rising continuously, with some retail price indices reflecting double-digit percentage increases in late 2025 and early 2026.

- Analysts estimate that NAND flash prices have doubled over a six-month period, squeezing SSD margins and retail rates.

- Even mainstream consumer drives like 1 TB SATA and NVMe SSDs that once cost around $35–$45 are now in the $100+ range, and some prices are rising further.

📦 Why Gadgets Could Cost More Soon

Memory chips and flash storage are core components in most gadgets — from laptops and smartphones to tablets and game consoles. When their costs rise:

1. Laptops and PCs

Memory and storage often account for a large share of component costs. One manufacturer warned that memory now could make up 35–40 % of total PC material costs, up from lower levels just a year ago.

This squeeze gives companies a tough choice: absorb costs and cut margins, or pass them on to customers. So far, some major brands are raising retail prices to protect profitability.

2. Smartphones

Although SSDs aren’t in phones, NAND flash is — and NAND shortages ripple into mobile storage pricing too. Tight memory markets can increase production costs across phone models, especially mid-range devices.

3. Gaming Consoles and High-End Devices

High-performance SSDs (NVMe or proprietary formats) are key to modern performance. When those components get more expensive, so can the devices that rely on them.

🕰️ What Could Happen Next?

Industry forecasts and insider commentary suggest a few possible trends in 2026–27:

🔹 Memory and storage prices may stay elevated for years. Some executives warn that tight NAND supply might stretch into 2027 or beyond as production capacity takes time to catch up.

🔹 Product launch timing might slip. Manufacturers may delay new gadget introductions or adjust specs to manage cost and supply challenges.

🔹 Consumer priorities could shift. With higher baseline prices, buyers might delay upgrades, opt for lower capacities, or buy used gear — all of which could influence market demand curves and retail strategies.

💡 Tips for Consumers Right Now

If you’re thinking of upgrading or buying new tech:

- Buy sooner rather than later. Prices may rise further in early 2026 for storage components.

- Watch for deals on storage upgrades. If an SSD price seems reasonable today, it might be better than waiting months from now.

- Assess your needs realistically. Don’t over-buy capacity you won’t use right away — it might save money in a tight market.

📉 A Broader Trend: The Super-Cycle

This memory crunch isn’t a short blip — it’s part of a longer “super-cycle” where AI and cloud computing demand reshape how semiconductors are made, prioritized, and priced. In this context, consumers may need to adjust expectations: technology won’t get cheaper as fast as it once did, at least in the short to mid-term.

-

bynaveen raj

-

January 27, 2026

You May Also Like

-

Oct 27, 2025

-

Oct 5, 2025

-

Oct 4, 2025

-

Sep 25, 2025

Sign up to receive our latest updates

Get in touch

Address

Landmark : Near Post Office